# Leverage , Margin vs LEAPs

**AMZN leverage Options vs Margin**

Todays date Dec 4th AMZN spot 145

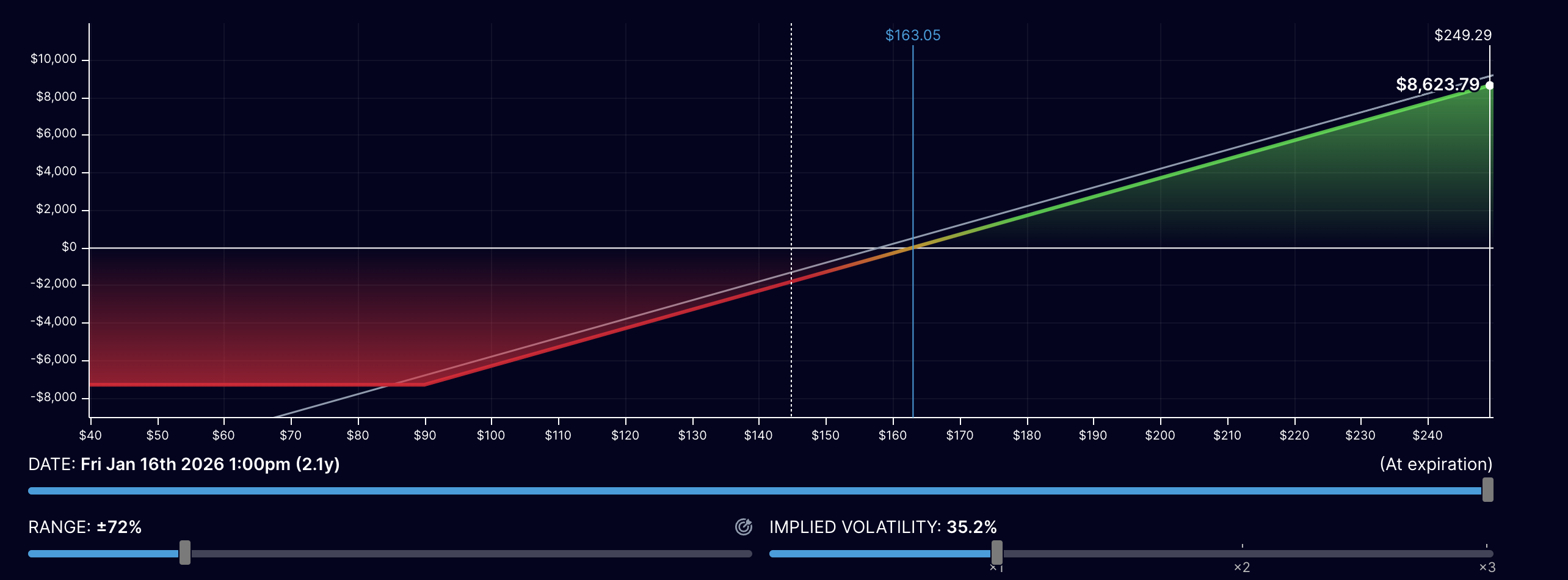

1. **STO** -1× AMZN 145P 1/16/26 at $21.20

2. **BTO** AMZN 145C 1/16/26 at $34.30

3. **BTO** AMZN 90P 1/16/26 at $4.95

Premium paid 18$

Max loss 18 + (145-90) = 73$ .. (This is the amount required to maintain the position as the broker would require this margin)

We get 2x leverage for 2 year. 18$ is the premium.

Here are some payout scenarios for one year. Please multiple all number by 2 to get the PnL of our leveraged trade

**Margin Trade**

Let’s keep it simple 2x margin leverage.

145 AMZN . For 15000$

I would have 100 shares paid in cash, and the remaining 100 shares in margin.

I would be borrowing 15000 for two years. At 6% compounded. That’s 11% in interest code.

15000\*12% = \~1800$ would be the interest cost on the entire trade.

So break even per share is 9$ i.e 154$ . (We get liquidated at 72 as opposed to 90 on the options trade)

——

Thoughts

So if we compare both the cases.

We get the same leverage but lesser cost for the margined trade

In the options trade, if we dont buy the put, we would have to margin for the put as AMZN price drops, else we risk liquidation.

——

Leverage via pure calls, high risk

If we dont sell the put at all, i.e we buy a naked call , we can get close to 4x leverage. Break even 177 , no liquidation

Margin. That’s the equivalent of borrowing 45000 for two years. 5400$. 400 shares. So 13$. Break even 158. But liquidation is 108.